VAT and Other Sales Taxes

Introduction

Value-Added Tax (VAT) plays a vital role in the global economy. As a broad-based consumption tax levied on the value added at each stage of production and distribution, VAT is an integral part of the fiscal policies of over 160 countries worldwide {IMAGE: A simple diagram showing the flow of VAT}.

Despite its widespread use, VAT is anything but simple. Rates differ from country to country, and even within regions of the same country. Rules can vary depending on the type of goods or services, and businesses must navigate the complexities of VAT in each jurisdiction they operate.

In this article, we will guide you through the VAT landscape in Europe, with a particular focus on Romania. We'll delve into recent developments designed to modernize VAT for the digital age, and explain how these changes could impact your business. Stick with us and you'll find that understanding VAT isn't as daunting as it may seem.

Chapter II: Understanding the VAT Landscape in Europe

To fully understand the impact of VAT on your business, it's crucial to grasp the context in which VAT functions, especially within the European Union (EU). While there is some harmonization of rules across the EU, significant variations remain between member states.

The Concept of 'Parking Rate'

A unique concept within the EU's VAT framework is the so-called "parking rate". It emerged as a transitional measure when Directive 92/77/EEC, a key regulation for VAT in the EU, was adopted in 1991. This directive aimed to standardize VAT rates across the EU, moving away from reduced, super-reduced, or zero rates applied by some countries to goods and services not specified by the new rules.

Countries were permitted to implement a "parking rate," a rate ranging from 12% to their standard VAT rate, to facilitate a smooth transition for these goods. While initially intended as a temporary measure, this "parking rate" persists in several countries to this day, despite ongoing discussions about its gradual elimination.

The EU's VAT Landscape

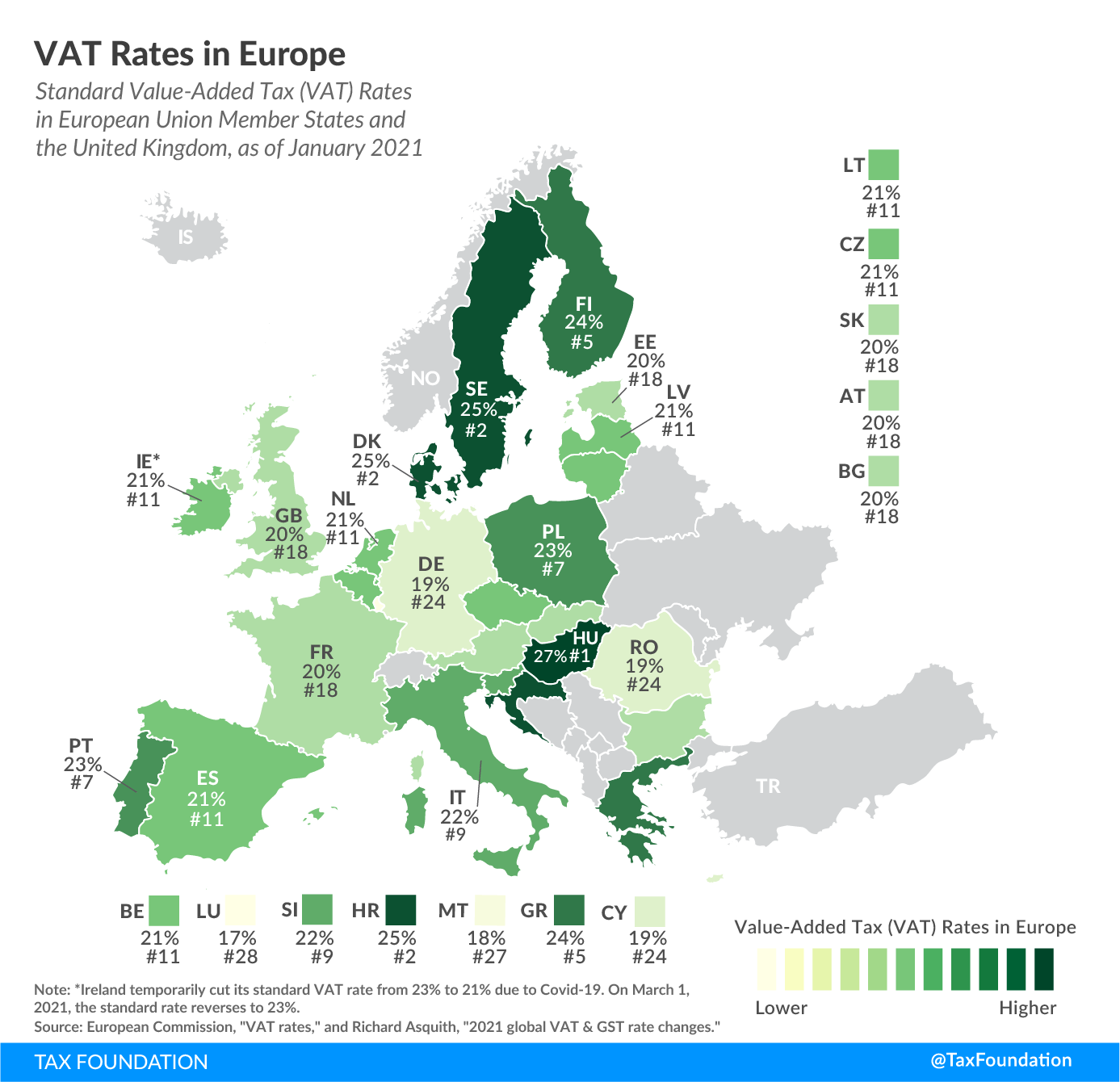

As of now, the standard VAT rates in the EU range from 17% to 27%, with the average sitting around 21%. However, 'parking rates' still persist in a few countries, and are applied to a varying range of goods and services. Let's take a look at some of these:

- Belgium (12% 'parking rate'): Applied to certain energy products and tires.

- Ireland (13.5% 'parking rate'): Affects an array of services and goods including energy for heating, the supply of immoveable property, and certain tourist services.

- Luxembourg (14% 'parking rate'): Covers products like certain wines, solid mineral fuels, and printed advertising matter.

- Austria (12% 'parking rate'): Applicable to wine from farm production carried out by the producing farmer.

- Portugal (13% 'parking rate'): Extended to wine, agricultural tools and machinery, and diesel for use in agriculture.

In the next chapter, we will focus on Romania and compare its VAT system with the rest of Europe, highlighting its advantages, especially for companies operating across borders.

Chapter III: Romania's VAT System in Focus

Romania, like all EU member states, follows the harmonized system of VAT. However, how it applies these guidelines, coupled with its own domestic rules, gives Romania's VAT system a distinct character.

VAT Rates in Romania

Romania's standard VAT rate is currently set at 19%, which is lower than the EU average of around 21%. The country also offers reduced rates of 9% and 5% on certain goods and services. For example, the 9% rate applies to certain foodstuffs, water supplies, and medical products for human and veterinary use. The super-reduced rate of 5% is applied to goods and services such as school textbooks, newspapers, and some cultural and sports events.

Advantages for Businesses

Romania's relatively low standard VAT rate and its reduced rates can be beneficial for businesses, particularly those operating cross-border or in sectors where reduced rates apply.

Cross-Border Operations

If your company is selling to businesses in other EU member states, you should be aware of the concept of "reverse charge". It means that the responsibility for reporting a VAT transaction is shifted from the seller to the buyer. This mechanism simplifies the VAT reporting process for sellers, making Romania an attractive base for companies with significant B2B transactions across EU borders.

Digital Goods and Services

For companies selling digital services to consumers in the EU, the "VAT One Stop Shop" (OSS) can simplify VAT obligations. Through the OSS, businesses can register for VAT in one EU member state (such as Romania) and use this single registration to declare and pay VAT on all distance sales of goods and cross-border supplies of services to customers within the EU.

This not only reduces administrative burden but also enhances transparency and efficiency in cross-border VAT settlement. It's another reason why Romania, with its competitive VAT rates and robust digital infrastructure, can be an excellent hub for digital companies.

The Digital Future of VAT in Romania

Given the EU's ongoing efforts to modernize its VAT system, the landscape is set to change even more in the coming years. The recently proposed measures by the European Commission aim to make VAT more resilient to fraud, more business-friendly, and better adapted to the digital age.

Key changes include real-time digital reporting based on e-invoicing, updated VAT rules for the platform economy, and a single VAT registration for businesses selling to consumers across the EU. These updates are expected to help businesses save billions in administrative and compliance costs and improve VAT collection by EU member states, benefiting economies like Romania.

Chapter IV: Navigating VAT in the Digital Age

The advent of digital technology has greatly reshaped how business is conducted, prompting tax authorities worldwide, including those in Romania, to adapt their policies accordingly. In this chapter, we delve into the changing landscape of VAT in the digital age, particularly as it applies in Romania.

Embracing Digitalization in VAT Reporting

One of the key measures proposed by the European Commission involves the introduction of real-time digital reporting for VAT purposes. This change is set to transform how businesses, especially those operating cross-border in the EU, report VAT.

The new system will be founded on electronic invoicing, which not only accelerates reporting but also furnishes Member States with precious real-time data to confront VAT fraud. This is anticipated to yield an annual diminution in VAT fraud of up to €11 billion. For businesses, the advantages are twofold: a substantial reduction in administrative and compliance costs and a convergence of national systems throughout the EU, thereby simplifying cross-border operations.

Updated VAT Rules for the Platform Economy

The digital age has seen the rise of the platform economy, where online platforms facilitate transactions between users. Recognizing the challenges this presents for VAT compliance, the European Commission proposes updated VAT rules that hold platform economy operators responsible for collecting and remitting VAT when their users do not.

This measure is expected to level the playing field between traditional and online services and simplify compliance for SMEs and individual platform users. Companies based in Romania that operate within sectors like short-term accommodation and passenger transport need to stay abreast of these changes.

The Introduction of a Single VAT Registration

The European Commission's proposal also includes the introduction of a single VAT registration across the EU. This builds on the existing 'VAT One Stop Shop' model, allowing businesses that sell to consumers in another Member State to register for VAT purposes once for the entire EU.

This single registration can be managed through an online portal in one language, simplifying VAT obligations for businesses operating cross-border. Such measures not only ease the administrative burden but also make Romania an increasingly attractive base for businesses with an EU-wide customer base.

The digital transition - Proposed European VAT standardization

As the EU continues to push for a modern, digital-friendly VAT system, businesses in Romania stand to benefit from simplified administrative procedures, enhanced fraud detection, and a leveled playing field between traditional and digital businesses. Staying abreast of these changes will be crucial for businesses to capitalize on these advantages and navigate the evolving VAT landscape with ease.

Chapter V: Ensuring VAT Compliance in the Digital Age

Given the rapidly evolving VAT landscape, ensuring compliance can seem like a daunting task for businesses. This chapter offers a concise guide to remaining VAT compliant in Romania amidst the digitalization of VAT systems.

Implementing E-Invoicing

With the proposed shift to real-time digital reporting based on e-invoicing, businesses should consider integrating e-invoicing solutions into their operations. This would entail either adopting standalone e-invoicing software or integrating it into existing accounting systems. E-invoicing simplifies record-keeping, reduces manual errors, and facilitates real-time VAT reporting.

Navigating the Platform Economy

Businesses operating in the platform economy need to stay updated on changes in VAT rules. This includes understanding their responsibilities for collecting and remitting VAT. It may be necessary to implement changes in business processes and systems to accommodate these new responsibilities.

Utilizing the VAT One Stop Shop

Companies selling to consumers in other EU countries should take advantage of the VAT One Stop Shop. By registering once for VAT purposes for the entire EU, businesses can streamline their VAT obligations, saving time and resources.

Chapter VI: Conclusion - Navigating the VAT Landscape in Romania

The Value-Added Tax (VAT) system is an inherent component of Romania's economic landscape and the broader European Union's economic structure. As emphasized in this report, grasping the intricacies of the VAT system can substantially advantage businesses functioning in Romania.

To summarize the key points:

- Understanding VAT Basics: The standard VAT rate in Romania is 19%, with reduced rates applied to certain goods and services. An understanding of these rates is crucial for businesses to calculate and report their VAT accurately.

- Changes in VAT Rules: The European Commission is pushing for a digital transformation of VAT systems to combat VAT fraud and ease compliance for businesses. This includes a shift towards real-time digital reporting through e-invoicing, new rules for platform economies, and a single VAT registration for businesses selling to consumers across the EU.

- VAT Compliance in the Digital Age: To ensure compliance with these new rules, businesses will need to implement changes such as adopting e-invoicing solutions, understanding new responsibilities in the platform economy, and leveraging the VAT One Stop Shop.

In the age of digitalization, the Romanian VAT system is becoming increasingly accessible, helping local businesses flourish and make their mark on the international stage.

This report was created to offer businesses a thorough understanding of VAT in Romania and the changes that are coming about due to digital transformation. However, unique business situations may necessitate customized guidance from legal or tax professionals to guarantee complete compliance and the optimal utilization of the VAT system.